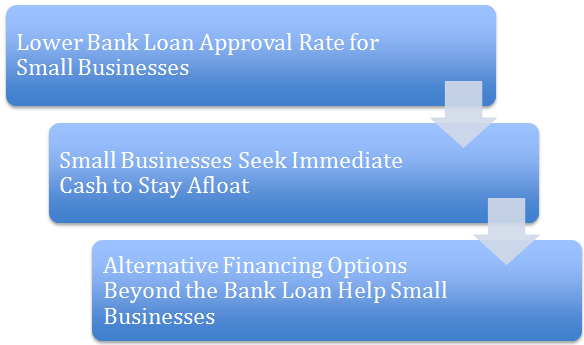

Businesses, particularly those small in size, rely on loans to thrive and prosper. Since 2007, lending regulations have become tighter resulting in the difficulty for small businesses to obtain loans from credit unions and banks. The small business community is working to stay afloat as loans continue to lag.

A recent report by the Biz2Credit Small Business Lending Index showed an increase by 4.3% from July to August in loan applications. Surprisingly, approvals by both big banks and credit unions decreased.Another report by Trepp, LLC found that 1 in 8 banks received a “failing” grade in an evaluation of over 6,000 banks U.S. wide. It comes as no surprise that small businesses are at the lowest approval rating in history. Nearly 40% of losses are a result of commercial real estate loans gone awry. Banks are keeping a tight hold onto capital in anticipation that the real estate market and unemployment rates may somehow correct themselves.

Many small businesses have been forced to seek out alternative ways to receive loans during the cash crunch. Small businesses seeking alternatives to bank loans for cash flow have numerous options. Businesses that are starting up and those that are in a period of rapid growth are strong candidates for non-traditional forms of financing options beyond the typical bank loan. Just make sure that you have a strong business plan, especially if you want to have a successful startup business.

Factoring

Factoring involves businesses selling their outstanding accounts to a commercial finance company, or a factor, at a discount of around 1.5% to 5%. The factor resumes responsibility for collecting the outstanding accounts receivable. Of the value, the business typically receives 70% to 90% and the balance when the factor collects the receivable.

Purchase Order Financing

Purchase order financing is one step beyond that of factoring. This type of financing is similar to factoring in that the business sells the invoice at a discounted rate to a finance company. This allows the small business to get the money more quickly.

Purchase order financing is a way small businesses can get loans and credit. Research shows that this type of financing helps businesses by offering to guarantee the purchase orders of the product that the company is selling. This is helpful because the financing company pays for the process of manufacturing and ships the goods from the factory. Costs associated with purchase order financing are around 4% to 5% to the small business.

Hard Money Loans

A hard money loan is a type of loan is based on collateral the small business can offer to the lender. A loan to value ratio for a hard money loan is calculated to establish the value of the property. Higher ratios result in less likelihood of obtaining the hard money loan. Lenders take about 70% of the property value.

A hard money loan is an asset-based loan. This type of loan provides money for needs such as investing in a project or providing financial options if the small company’s business lines are all in use.

Merchant Cash Advances

If a small business is unable to get a bank loan, an alternative financing source is a merchant cash advance. This bank loan alternative provides immediate cash and keeps small businesses afloat. Merchant cash advances are appealing to companies as they are not given a date to pay the advance off. As credit card sales are made, the cash advance is paid according to the terms of the loan. An added benefit is that securing the merchant cash advance does not require collateral.

Ideal for retailers, business-to consumer companies tend to use merchant cash advances. Most companies are able to pay off merchant cash advances within a year, and sometimes in even half that time.

Small businesses sometimes back away from alternative financing options. Reasoning is typically due to lack of understanding the financing option or because they are unsure of the associated costs. Browsing for loans online is a good way to start or you can talk to an experienced lender to help you out. Experienced lenders are able to help small businesses owners get a better grasp on the many options available to them. These lenders can assess the pros and cons of the financing options specific to each company. As small businesses deal with longer payment terms from their customers, alternate financing options are a possible solution to increasing the flow of cash in the present.

This guest article was provided by ChamberofCommerce.com.